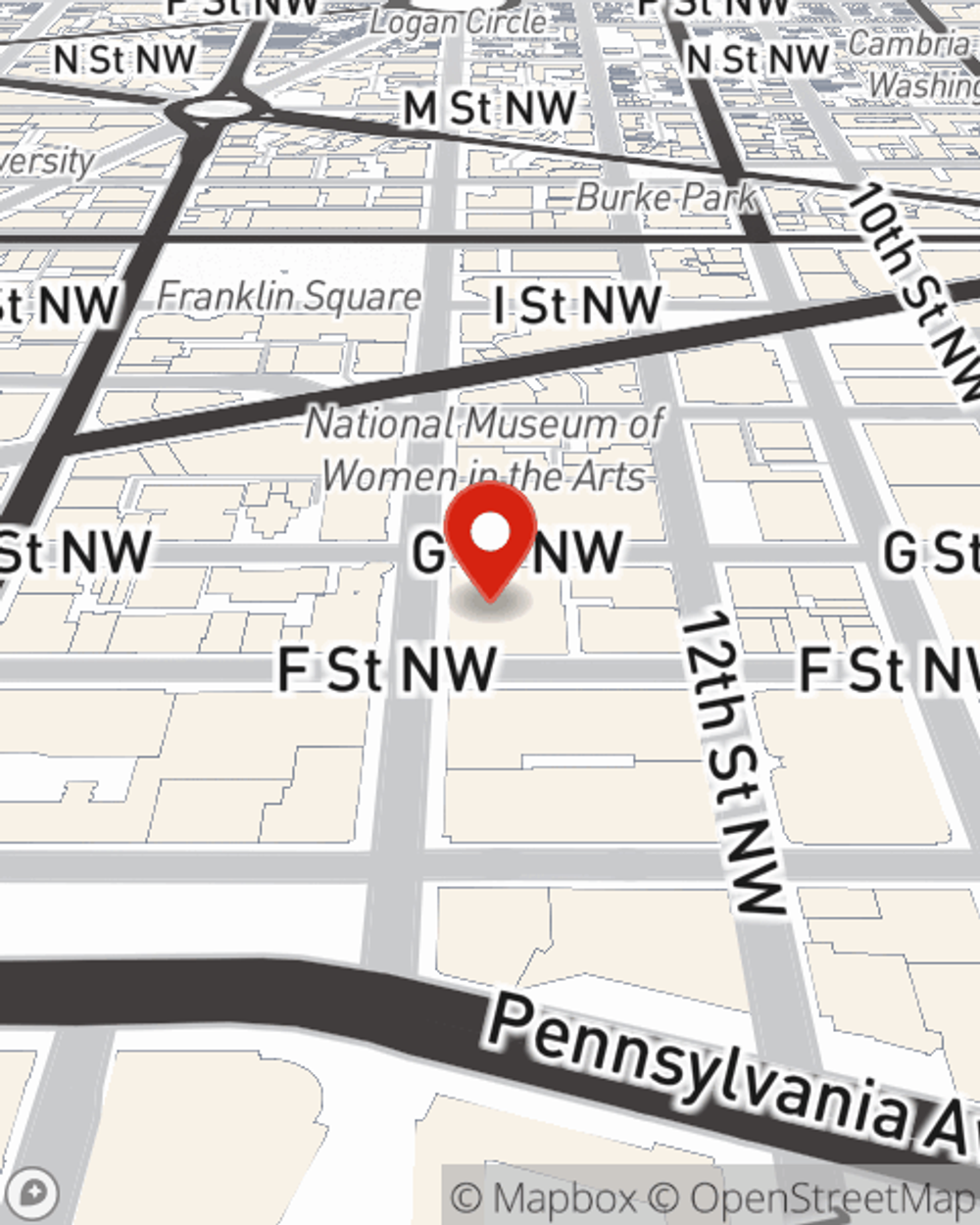

Business Insurance in and around Washington

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

- Arlington, VA

- Columbia Heights

- Capitol Hill

- U Street NW

- Georgetown

Insure The Business You've Built.

Whether you own a a veterinarian, a lawn care service, or a bakery, State Farm has small business protection that can help. That way, amid all the different decisions and moving pieces, you can focus on your next steps.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Chris Miller. With an agent like Chris Miller, your coverage can include great options, such as business owners policies, commercial auto and worker’s compensation.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Chris Miller's team to review the options specifically available to you!